17th Mar, 2025 Commercial Real Estate

Behind the Server: A Contrarian View on Data Centre Investment

Warren Buffett once said, “Be fearful when others are greedy.” In the frenzy surrounding data centres, his words have never felt more relevant. What was once a niche segment of commercial real estate has become a multi-billion-dollar arms race for digital infrastructure. With AI, cloud computing, and an increasingly connected world driving unprecedented demand, investors are piling in, lured by the promise of high yields and long-term necessity. But are they stepping into a goldmine or a ticking time bomb?

Beneath the surface of this data centre boom lies a labyrinth of challenges. The future of AI remains uncertain, land is scarce, power constraints are tightening, and environmental concerns are growing louder. Meanwhile, high construction costs, supply chain disruptions, and a critical skills shortage threaten to reshape the sector’s investability. The question is: will this industry’s soaring appeal translate into sustainable returns? Or are investors charging ahead without fully grasping the risks? The key to success lies in navigating these obstacles strategically—turning threats into opportunities.

- The AI Mirage: Boom or Bust?

The world is racing to build the infrastructure that will power artificial intelligence, with Goldman Sachs predicting a staggering $1 trillion to be spent on building AI-supporting infrastructure in the coming years. However, is AI really the unstoppable force investors believe it to be?

Despite the hype, a clear, long-term profit model for AI is still missing. Unlike past computing cycles that gave rise to money-making machines like Enterprise Resource Planning software, AI has yet to reveal its “killer application.” Even if it does emerge, will AI deliver the game-changing returns investors expect?

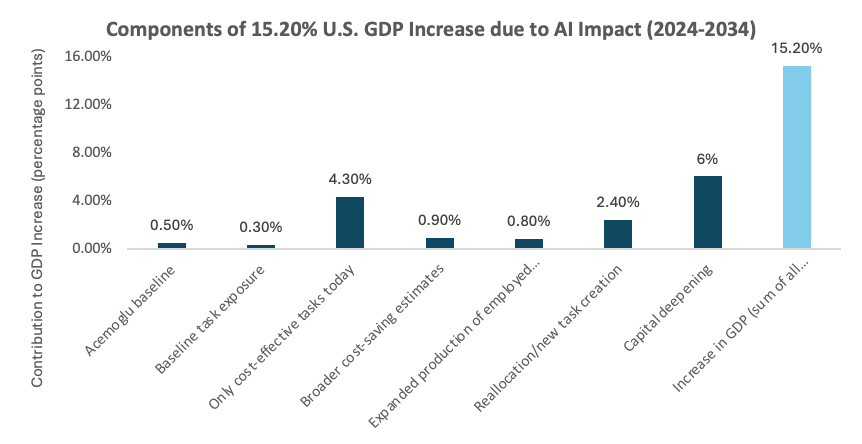

Meanwhile, major challenges lurk beneath the surface. Hardware shortages are mounting, and power constraints threaten to derail AI’s trajectory. Goldman Sachs estimates that AI will boost U.S. GDP by 15.2% over the next decade, a more optimistic forecast. Yet, they also claim that though “we’re a couple years into [AI], there’s not a single thing that this is being used for that is cost effective at this point.” While AI’s full potential remains an open question, one thing is clear—investors banking on AI as an immediate game-changer may be in for a long and uncertain wait.

Source: Goldman Sachs 2024

- Land Shortages: The Silent Killer

Sydney’s data centre vacancy rates have plunged from 17% to 12% in just six months, with demand only expected to continue to accelerate. CBRE Research shows that the investable universe of the Australian data centre is projected to nearly double to AUD 40 billion in the next four years. Yet there’s a catch—land is running out.

Unlike traditional real estate, data centres need land that meets highly specific criteria: close to power, cooling resources, and end-users. In tightly held markets like Australia, developers are already feeling the pressure, fearing they may follow in the footsteps of Hong Kong and Singapore, where limited land supply has reduced the global significance of these markets.

With industrial and logistics sectors competing for the same land as data centres, developers are adapting. This includes repurposing older buildings and adopting the powered shell models—where facilities are constructed with completed exteriors but customisable interiors. Though tenant operators were previously reluctant to partner with industrial landlords, they are now leasing such unfinished spaces with data centre potential, to secure faster entry into a tightly held property market amid declining vacancy rates. For investors, these supply limitations and rising demand present an opportunity to enter the market early and capitalise on the sector’s growth.

Investors looking for long-term growth should also take note that the biggest winners in this space may not be those chasing prime locations, but those who anticipate the shift toward regional and decentralized infrastructure.

- Power: The Make-or-Break Factor

According to Australian Energy Council, a single large data centre can consume as much power as 50,000 homes. Australia’s 231 data centres currently consume 5% of the national grid, and that figure is expected to climb to 8% by 2030 (Morgan Stanley, 2024). As demand skyrockets, limited energy capacity and interconnectivity constraints are emerging as one of the sector’s biggest threats.

With power availability decreasing, data centres with lower power usage effectiveness (PUE) are becoming increasingly attractive to investors. A DLA Piper survey found that 7 out of the 11 countries identified as the most undervalued data centre markets were in the Asia-Pacific region, with Australia topping the list for 49% of respondents. This suggests significant opportunities for investors to acquire undervalued assets in Australia and implement PUE reduction strategies to improve operational efficiency.

The push towards alternative energy supplies is also driving data operators to explore on-site substations and hourly matched renewables—buying renewable energy in real-time rather than annually. These solutions may dictate which data centres thrive and which become stranded assets in an energy-constrained world.

- Environmental Sustainability: The Race to Green Data Centres

As AI adoption accelerates, data centre energy consumption is surging, placing immense pressure on electricity grids. According to Goldman Sachs, a single ChatGPT query consumes nearly ten times more energy than a standard Google search, and by 2030, data centre emissions are projected to reach 2.5 billion metric tonnes of CO2 equivalent (Reuters, 2024). In response, the government is tightening energy efficiency regulations, mandating all new and existing data centres to maintain 5-star NABERS Energy rating, by July 2025. Data centres with high ratings are expected to maintain strong investment value, while non-compliant centres risk financial penalties and declining market appeal.

To address the rising demand for green energy, companies are integrating on-site renewables, power purchase agreements (PPAs), hydrogen fuel cells, and tri-generation systems to improve efficiency. However, renewable energy infrastructure requires 5-10 years to develop, and supply inconsistencies have sparked interest in nuclear energy as a potential solution. The Australia Institute found that this energy transition towards renewable electricity generation is “also a spatial shift” to more rural and regional areas as wind and solar plants are constructed in non-urban locations. This presents a strategic opportunity for data centres to be built in proximity to these electricity generating sites, specifically ‘Renewable Energy Zones’ as named by the NSW Government.

- Cooling: The Hidden Cost of the Digital Boom

Cooling accounts for 40% of a data centre’s total power consumption (McKinsey & Company, 2023), with some facilities using up to 19 million litres of water daily—equivalent to the daily water consumption of 50,000 people (Australian Energy Council, 2023). As AI-driven data processing intensifies, these figures are only set to rise, bringing both environmental and cost implications.

Immersive cooling, where servers are submerged in dielectric liquid, is emerging as a game-changer, slashing cooling costs by up to 95% (Investa, 2024) while dramatically improving energy efficiency. Power Usage Effectiveness (PUE) is a metric that reflects the energy efficiency of a data centre. A PUE of 1.0 indicates that all energy is directed solely to IT equipment, with no energy expended on functions like cooling or lighting. While the industry’s average PUE is approximately 1.55, immersive cooling technology can enable an improved PUE of 1.10, representing a 29% gain in efficiency.

These advancements may redefine the industry’s geographical footprint—eliminating the need for cold climates and enabling construction in previously unsuitable locations.

- Construction Costs: The Price of Entry

Building a data centre is no small feat. CBRE research reveals construction costs average AUD 15 million per MW of capacity, creating high barriers to entry and thus, narrowing the pool of potential developers. 44% of costs go to electrical systems alone, suggesting that the bulk of the expenses stem from internal systems like advanced cooling and computing equipment rather than the physical structure or land.

Rising inflation, material costs and supply chain delays add further strain. Hence, developers are responding with strategic partnerships, joint ventures, and powered shell facilities to cut costs. Those who fail to adapt may find themselves priced out before they even break ground.

- The Skills Crisis: Who Will Run These Facilities?

The data centre industry is facing a dire talent shortage. A survey conducted by Uptime Institute in 2023 found that over half of global operators reported difficulty finding skilled staff. Especially as the average data centre engineer is aged 60, the sector risks losing decades of institutional knowledge as seasoned professionals retire. If this knowledge gap isn’t addressed, operational efficiency and future expansion could be in jeopardy.

The industry’s future demands are stark: Uptime Institute projects a global need for 2.3 million full-time employee equivalents by 2025. Addressing these challenges will require a comprehensive approach, emphasising upskilling and cross-training professionals, as well as attracting talent from adjacent fields. Governments and industry leaders are also racing to fill the void, with the Australian Government seeking to achieve 1.2 million technology-related jobs by 2030.

Conclusion: Hype vs. Reality

The data centre sector is at a crossroads. On one hand, the world’s growing dependence on cloud computing, AI, and digital infrastructure makes these facilities indispensable. On the other, the sector faces a perfect storm of land shortages, power constraints, sustainability challenges, rising costs, and a talent crunch.

For investors, the message is clear: data centres are not a one-way ticket to easy profits. Success will depend on strategic foresight—identifying undervalued assets, mitigating power and cooling risks, and capitalizing on the shift toward regional development and modular construction.

- Build to Rent

- Commercial Real Estate

- Construction

- Construction Finance

- COVID-19 and Real Estate

- Data Centres

- Economy

- Office/Industrial Real Estate

- Real Estate Development

- Real Estate Investment

- Real Estate Lessons

- Real Estate Projects

- Residential Real Estate

- Retail Real Estate

- Social Media Technology

- South Sydney Market

- Sustainability

- Technology

Popular Posts

- From Concept to Concrete: Is Build to Rent Australia’s next Real Estate Frontier

- Weather the Storm: Navigating Challenges in Australia’s Construction Industry

- Behind the Server: A Contrarian View on Data Centre Investment

- Back of the Envelope Analysis (BOE): Your Investment Master Key – Part 1

- Monopoly Not A Good Analogy To Real Estate

- Social Technologies Changing the Real Estate Industry

- Has Flattening the Curve also Flattened our Residential Sector?

- Relationships, Reputation & Real Estate Ventures

- Burst of Activity in the South Sydney Market

- CBD Fringe Apartments are the Best Bet

Latest on Twitter

Behind the Server: A Contrarian View on Data Centre Investment | Trident Real Estate CapitalTrident Real Estate Capital #DataCenters #RealEstateInvestment #TechInfrastructure #CommercialProperty #ContrarianInvesting #PropTech

From Concept to Concrete: Is Build to Rent Australia’s next Real Estate Frontier | Trident Real Estate CapitalTrident Real Estate Capital https://shar.es/agrcaf

#btr #buildtorent #australianrealestate #urbanliving #urbandevelopment #propertyinvestment #rentalmarket

Weather the Storm: Navigating Challenges in Australia’s Construction Industry | Trident Real Estate Capital Costa Argyrou https://shar.es/afSKBM

#ConstructionIndustry #BuildingChallenges #LabourShortages #SupplyChainDisruptions #CostEscalations #Insolvency #realestate #Building