From Concept to Concrete: Is Build to Rent Australia’s next Real Estate Frontier

In recent times, the Australian real estate landscape has witnessed a paradigm shift with the growing prominence of the Build-to-Rent (BTR) sector. This emerging trend represents a significant shift towards creating tailored, long-term rental accommodations, reflecting a broader change in housing preferences and investment strategies.

To fully grasp the essence and trajectory of BTR in Australia, it’s crucial to explore the complex interplay of factors that fuel its rise and the hurdles it faces. Commercial feasibility, regulatory frameworks, and evolving societal norms all play critical roles in shaping the BTR landscape. Factors such as affordability concerns, demographic shifts favouring rental accommodations, and the quest for sustainable, community-centric living environments are driving demand. Concurrently, issues like stringent tax policies, planning controls and funding challenges, and the nascent nature of the market present formidable obstacles.

As we delve into the nuances of BTR, from its market size and key characteristics to the challenges and opportunities it presents, it becomes evident that this sector holds the potential to significantly impact Australia’s housing market.

What is Build to Rent?

BTR is a widely interpreted term, which is unsurprising given the various stakeholders in the industry such as developers, investment managers, bankers, architects and local authorities. Arriving at an agreed definition is further complicated as a result of geographic differences, where BTR is known by various names around the world.

NSW Planning characterizes BTR with four succinct attributes:

- Large Scale: Developments typically feature 300-400 units, underscoring their large-scale nature.

- Purpose-Built: Specifically designed for long-term rental rather than immediate sale, emphasizing a commitment to lasting investment.

- Single Ownership: BTR are usually under single ownership, often by entities focused on long-term capital investment.

- Professional Management: Managed by professional, on-site teams to ensure high-quality tenant experiences.

For a deeper exploration and global perspective, delve into our comprehensive study “Is Australia Ready to Rent and Roll“, available in our research publications.

The Size of the BTR Market in Australia

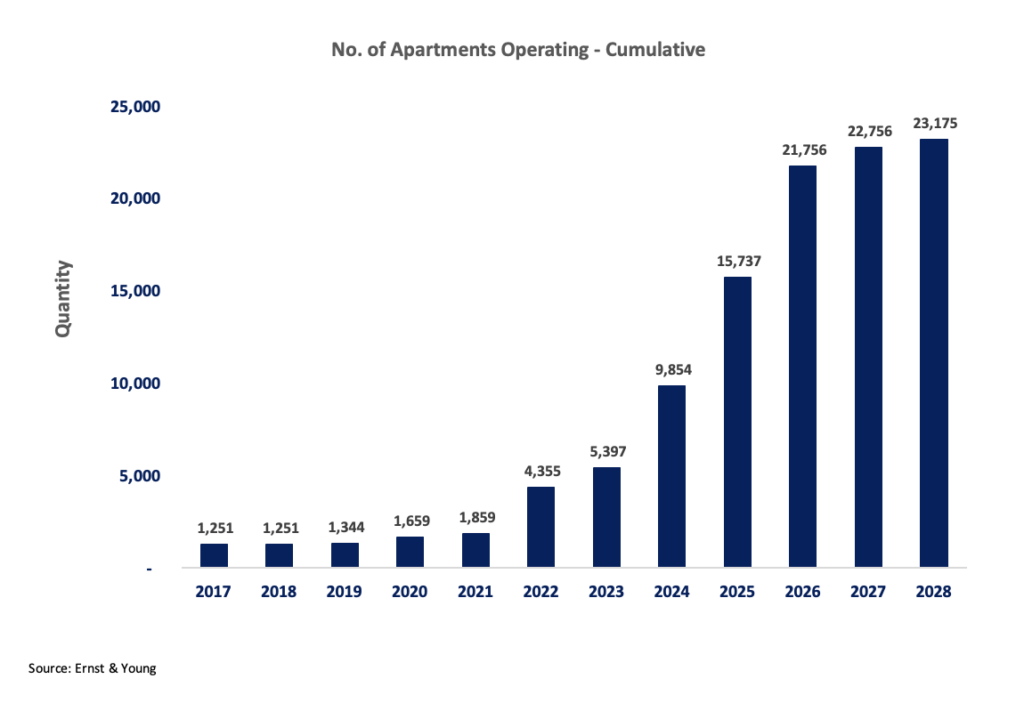

BTR is a burgeoning gem within Australia’s vast $10 trillion residential sector. According to Ernst & Young (EY), the BTR sector is currently valued at $20 billion and consists of 27,000 apartments strewn across 82 innovative projects across 27 operating platforms. Construction in this sector is buzzing with activity, with 14,000 BTR units currently under construction, while another 9000 are in the planning phase, poised to transform the residential landscape.

Despite its nascent stage, representing a mere 0.2% of the residential sector, EY casts a vision of remarkable growth for BTR. They forecast a leap to over 3% of the market share, potentially elevating the sector’s worth to a staggering $290 billion. This projection paints an optimistic future for BTR where it becomes a cornerstone of Australia’s housing market, offering vibrant, community-centric living spaces.

Key Characteristics of BTR

Diving into the BTR landscape, we find a product mix heavily weighted to smaller apartments reflecting modern lifestyle living, with 70% of the offerings being cosy studios and one-bedroom apartments. A further 25% slice of the BTR product mix is made up of more spacious two-bedroom units, while the three-bedroom apartments, offering ample space for families or roommates, make up a mere 5%.

A standout feature of BTR properties is their generous communal amenities, ranging from four to seven square meters per apartment, including rooftop facilities, barbecues, gyms and pools, a stark contrast to the minimal one square meter typically found in build-to-sell properties.

Strategically nestled within a 10 to 15km radius of the bustling CBD, the majority of BTR developments are conveniently located near major transport links, including heavy and light rail, making them very attractive for the vibrant Millennial and even Generation Z crowd. This demographic, a large majority of whom are under 35, finds in BTR an urban sanctuary they yearn for but often find out of reach to purchase.

Investment Metrics

BTR investments present a nuanced picture of returns, with initial yields hovering around the 4% to 4.5% mark while reversionary yields edge up to 4.75%. Transaction evidence mirrors this range, with BTR assets typically transacting at capitalization rates of 4-4.5%. This was evident in Mirvac’s June 2023 sale of a 56% stake in its $1.8 billion BTR platform to CEFC and Mitsubishi Estate, reflecting a cautious market consensus on valuation.

EY’s comprehensive analysis sheds light on the prospective financial outcomes associated with BTR investments, indicating that equity internal rates of return may vary from 10% to 14% after accounting for taxes and fees. This range is indicative of a potentially attractive investment opportunity, yet it underscores the importance of a thorough assessment of market uncertainties and operational expenses. Furthermore, the analysis anticipates stabilized IRRs to lie between 6.5% and 7.75% before taxes and fees, predicated on the assumption that rental growth rates will hover around 3-4% over a ten-year forecast period.

What is preventing BTR from reaching new limits?

What factors have hindered BTR from achieving even greater success, despite its proven track record and high demand in international markets?

1) Funding Challenges: BTR projects are characterized by their need for substantial initial funding for land acquisition design and construction, with returns on investment accruing gradually through rental revenues over an extended period. This model of long-term gains presents a notable challenge in acquiring the necessary capital. In the Australian context, this is particularly evident as foreign capital represents approximately 80% of the investment in the sector. Local superannuation funds exhibit caution towards BTR investments due to several factors:

a) Market Novelty: The BTR asset class is relatively new in the Australian market, leading to a cautious stance from superannuation funds that prefer to invest in tried-and-tested sectors due to their risk-averse nature.

b) Home Ownership Overlap: Many superannuation fund members already own homes, leading to a concentration risk. Investing in Australian BTR could intensify their exposure to the domestic real estate market, essentially compounding their investment in a single sector.

c) Preference for International Diversification: Superannuation funds tend to favour BTR investments in established markets abroad, seeking not only proven returns but also the added benefit of diversifying their investment portfolios internationally.

2) Planning Control Issues: The nuanced regulatory framework encompassing the State Environmental Planning Policy (Housing) 2021 and the Better Apartment Design Standards, despite offering some flexibility, can still pose challenges to the expansion of the BTR sector. These regulations/planning controls, by setting rigorous criteria for design, sustainability, and tenant amenities, require developers to invest considerable time and resources in compliance, potentially elevating project costs and complexity. While the intention is to ensure quality living spaces, the intricate balance between meeting these planning standards and maintaining project viability create uncertainty, delay projects and increase costs. Furthermore, the necessity to adhere to specific design parameters, such as apartment size, layouts and access to natural light may limit the adaptability of BTR projects to diverse market needs and preferences. This is particularly evident in Sydney, where the intricate planning process can extend the timeline for development consent to up to six years, further complicating the growth trajectory of the BTR sector in a competitive real estate landscape.

3) Construction Costs: While escalating construction expenses pose a challenge across various development projects, their impact on BTR ventures is particularly pronounced due to several factors. BTR developments typically prioritize high-quality construction and comprehensive amenities to attract and maintain long-term residents, leading to increased initial construction costs. This is in contrast to build-to-sell projects, which may not require the same level of investment in tenant retention features, allowing for a different, potentially less costly, construction approach. Moreover, BTR projects often favor urban or strategically located suburban areas to cater to desired demographics, such as young professionals and families seeking close proximity to employment and lifestyle amenities. This preference for prime locations can elevate land acquisition costs, further intensifying the financial burden of construction costs. For instance, in Sydney, land costs can constitute around 30% of the total project costs, posing significant challenges to the financial feasibility of BTR projects. Meanwhile, in Melbourne, land costs represent a somewhat lower proportion of total project expenses, ranging from 15% to 20%, offering more favorable economic landscape for BTR developments.

4) Taxes: Tax-related obstacles remain a significant barrier to investment in the BTR sector, notably including stamp duty and land tax surcharges, Managed Investment Trust (MIT) withholding tax, and the Goods and Services Tax (GST). To alleviate some of these pressures and stimulate housing supply, several states have introduced incentives, such as a 50% reduction in land value for land tax purposes and exemptions for foreign investors from certain surcharges. At the federal level, a notable initiative is the reduction in MIT withholding tax for new residential BTR projects starting after 1 July 2024. This policy adjustment will enable foreign investors from specified jurisdictions to benefit from a lower withholding tax rate, decreasing from 30% to 15% on fund payments related to BTR projects in Australia. However, the GST treatment of BTR projects continues to pose a challenge. Unlike developers in build-to-sell projects who can reclaim their input tax credits, thereby offsetting the GST costs upon sale, BTR developers are precluded from doing so. This results from a specific provision in the GST Act (Division 129), which deems the lease of new residential premises as an input-taxed supply, effectively imposing a 10% cost premium on BTR developers. Consequently, the effective yield of a typical BTR project, which would ordinarily range between 4-5%, is diminished by approximately 0.4-0.5% due to these indirect tax implications, a figure that could escalate with any increase in yield.

5) Subpar Returns: All developers are faced with the same rising construction costs. However, unlike traditional projects costs, BTR developers must take on the additional ongoing maintenance and refurbishment expenses due to the long-term rental nature of these projects. This business model also necessitates the employment of a full-time management team to foster an ‘operational mindset’, emphasizing brand and resident experience, similar to hospitality or student accommodations. Consequently, the yields on BTR projects at 4.5% to 5% are less attractive when compared to the potential 5.5% to 7% from the office sector and 5.5% to 6% from the retail sector (Dexus and JLL). The potential risks of unfeasible projects or subpar returns further underscore this disparity. Blackstone’s recent decision to halt transactions on BTR projects for the current quarter, pivoting to explore other strategic ventures, is a testament to these challenges. Despite the lower yield, BTR investments are highly regarded for their stable and dependable income flows. They are characterized by lower vacancy rates, minimal volatility in returns, and the ability to produce returns that outpace inflation. These attributes make BTR investments particularly appealing to investors who prioritize risk management.

6) COVID-19: The COVID-19 pandemic has caused changes in living patterns, which may have temporarily affected the growth of BTR in Australia. The pandemic increased demand for larger living spaces and properties with outdoor areas. This shift in preference has made BTR developments, which are often located in urban areas and may not always offer spacious living arrangements given that 70% of the product offering are studios and one bedrooms, less attractive to potential renters.

Conclusion

As we reflect on the journey of the BTR sector in Australia, it becomes evident that the momentum it has gained is not just a fleeting trend but a reflection of the evolving preferences and needs of the modern Australian. The confluence of rising rents, favourable tax changes, and a shift in housing priorities positions BTR as a promising asset for both investors and tenants. However, for the sector to truly flourish and match the scale seen in global counterparts like the US and UK, addressing the existing planning, tax and financial challenges is imperative. The road ahead for BTR in Australia is filled with potential, but its success will hinge on the collaborative efforts of developers, policymakers, and investors. As the landscape continues to transform, the BTR sector stands as a testament to the ever-changing dynamics of the Australian real estate market and the innovative solutions that arise in response to them.