The House View: Please Don’t Stop the Music

There’s a lot being said about Australia’s residential property market right now, where property prices have grown by a staggering 20.3% in the past year.

Contagion fears arising out of Evergrande’s bumpy debt restructuring process were the hot topic of early October. However, Australian speculation has been focused on the likelihood of further macroprudential cooling measures being introduced to curb household debt levels and expectations that the RBA will commence its interest rate neutralisation sooner than initially expected given record vaccination rates and high headline inflation. All this speculation is occurring against the backdrop of a property market that is shouting out for higher inventory levels, and market participants with palpable fears of ‘missing out’ who are increasingly willing to compromise on their selection criteria just to get into the market.

In this piece, Trident Real Estate Capital will dive into the fundamentals impacting Australia’s residential property sector and consider whether this asset bubble will continue to grow or if there are signs that the bubble is about to burst!

Residential Sector Trends

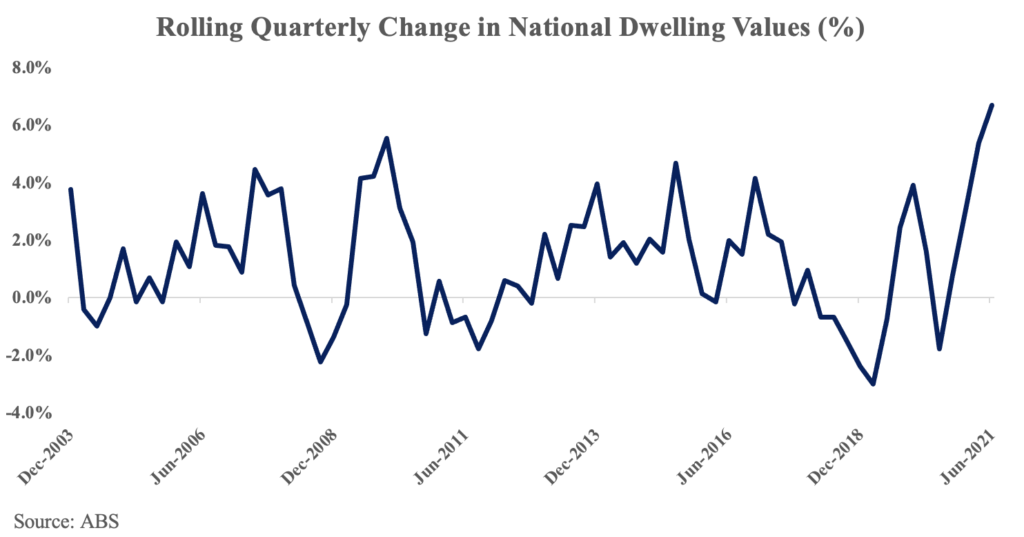

Australian house prices rose by 20.3% over the past year, the fastest rate of growth in over three decades. While monthly growth has slowed from the peak in March, it remains very elevated – in the 96th percentile of growth rates over the past 30 years according to Morgan Stanley. Strong dwelling price growth has been broadly synchronised across Australia. This is surprising considering the vastly different COVID-19 restrictions imposed by each state and given certain markets, such as rural Western Australia and Darwin, typically have counter-cyclical dynamics.

The impact of the extended lockdowns in NSW and Victoria looks to be limited, with sales since May 2021 down 9% in Sydney and 65% in Melbourne. Transactional activity has been less sensitive in Sydney because, unlike in Melbourne, one-on-one inspections have still been permitted. On these lower volumes, the last three consecutive national preliminary auction clearance rates have been above 80% (Core Logic). Last week’s figure was 83.3%, almost seventeen percentage points higher than this time last year, and well above levels which have historically implied price increases.

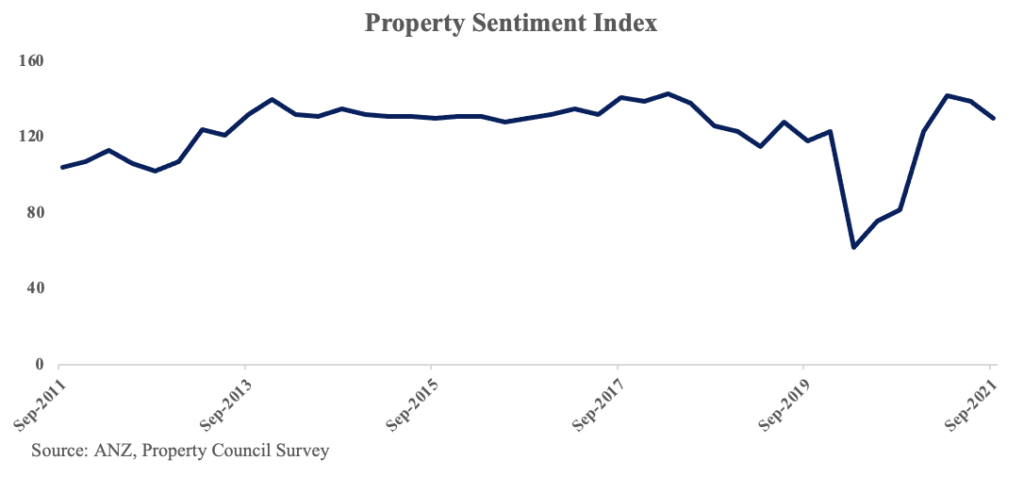

House price expectations improved in September and are at a multi-year high according to Westpac. However, the proportion of people who think it is the right time to buy a house has pulled back sharply across Australia. This may reflect the belief that the current rate of growth is unsustainable, and the expectation that APRA will continue to intervene to throw sand in the wheels of credit growth.

Unsurprisingly, rental yields have continued their downwards trajectory across all cities in September 2021 as the rise in rents struggle to keep up with the steep upward trajectory of house prices. Interestingly, the increase in the number of expats returning to Australia earlier than expected, as a result of the pandemic, has meant that rents for family homes with large open spaces, that are appealing for working from home professionals, have been particularly strong given the lack of supply.

Leveraging Consequences

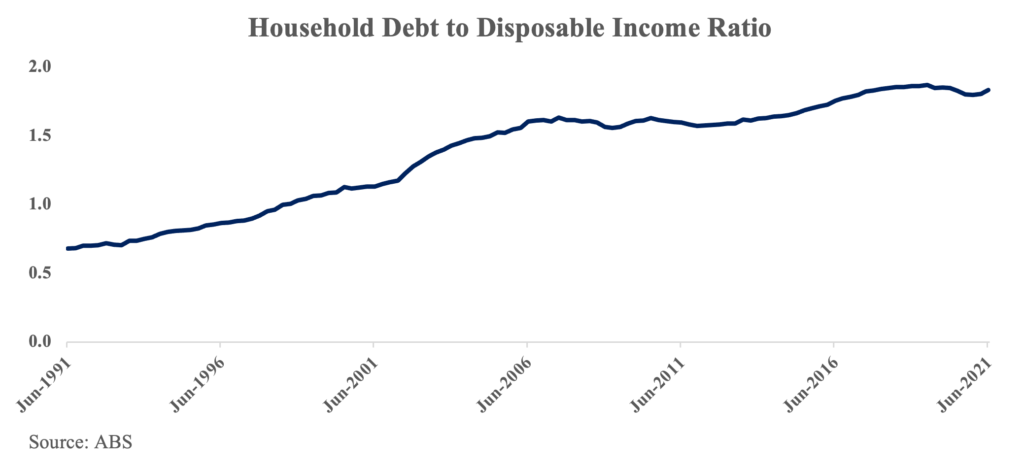

The leveraging consequences of the strong housing market are starting to emerge. Housing credit growth continues to pick up, growing 0.6% last month and 6.2% this year, according to UBS. With loan approvals up 47% this year, this growth will likely continue through to 2022. As a result, household debt levels are deteriorating each quarter. Morgan Stanley estimates this deterioration could add 20 percentage points to household debt-to-income levels, which are already elevated relative to other economies at 180%. Regulators are very concerned with the meaningful gap between household credit growth and income growth.

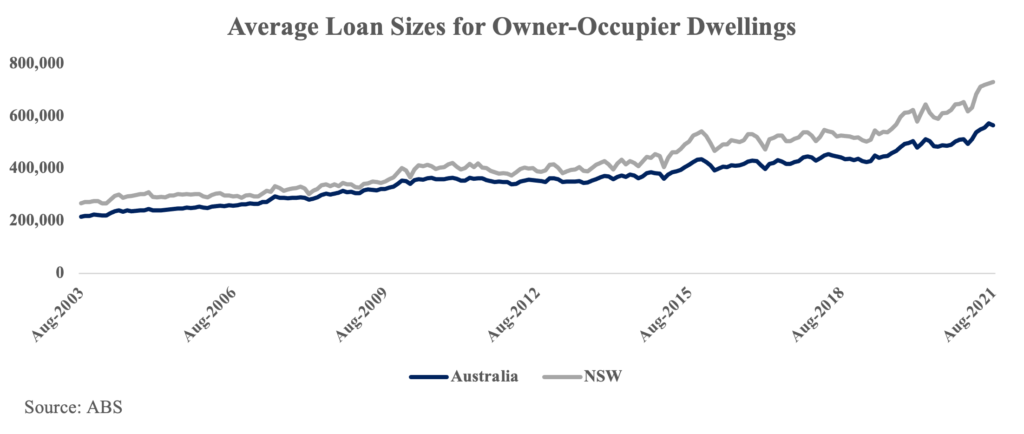

There are further concerns about the quality of home loans. The average owner-occupier home loan size in NSW has risen by 18% since February 2021(ABS) and the share of home loans with very high debt-to-income multiples of above six is now 21.5%. EL Data shows that the requirement for a guarantor has now reached a record 36% share of all loans. Meanwhile, mortgage surveys from UBS provide an indication that there has been a material deterioration in home loans. The share of home loans that are misstated increased to another record high of 41%, up from 38% last year. The magnitude of misstatement also lifted with a much larger over-statement of income (especially those overstating income by 25% plus) and greater understatement of financial commitments and living costs.

Against the backdrop of booming dwelling values, it seems that purchasers are chasing the market in a buying frenzy, eager not to miss out on rising prices, resulting in more loans being granted at the maximum borrowing capacity.

Outlook for the Residential Sector

Looking at things more broadly, there are a handful of factors weighing on the outlook for residential sector, from both sides of the aisle.

We believe the following factors will act as tailwinds going forward:

a. Auction Clearance Rates a Positive Sign: There have been few signs of serious disruptions from lockdowns with respect to the real estate market. Auction clearance rates remain above 75% in all capital cities in recent weeks, implying positive signs for the demand backdrop.

b. The Reintroduction of Overseas Migration: It has been widely reported that there are still 38,000 Australian’s stranded abroad. The return of these citizens may add some heat to the demand pipeline. Dominic Perrottet has further floated the idea of doubling migration rates for a 5-year period, to catch up on numbers lost during COVID-19. However, only 40% of overseas migration to Australia is permanent and these 40% generally tend to rent initially rather than buy. This means that any build up in the demand pipeline from overseas migration is likely to be some time away yet.

c. Interest Rates on Hold: The Reserve Bank has repeatedly stated that it is committed to keeping interest rates low to accommodate economic recovery. Trident Real Estate does not consider that the RBA will lift interest rates in the very short term for the following reasons (1) there is a lot of noise in macroeconomic data around the reopening of Australian economy post lockdown, (2) the RBA is focused on quantitative easing tapering and other non-rate issues, and (3) the RBA has shown a willingness to use macroprudential tools to address the serviceability of loans and the amount of credit that can be obtained by individual borrowers rather than use interest rate increases to tackle surging house price values. In our recent research piece; Inflation: A Permanent-Transitory Conundrum, there was considerable weight to the argument that headline inflation may not be so transitory and remain persistent in the medium term. We would therefore not be surprised if inflation continued to be above the 2-3% target band. However, unless data indicates that this inflation is driven by a tight labour market rather than supply constraints, it would appear unlikely to cause rate increases in the very near-term.

d. Appointment of Dominic Perrottet: The appointment of the new Premier may act as a tailwind because he is a vocal advocate for stamp duty reform. Mr Perrottet has previously presented a property tax proposal which would give buyers in NSW the choice to pay stamp duty, or an annual property tax based on their land and property use. If implemented this would be expected to increase property prices by reducing transactional costs. Against the current backdrop of increasing capital requirements for loans as house prices soar, the removal of these additional transactional costs would be significant.

Trident Real Estate Capital believes the following factors will act as headwinds going forward:

a. Removal of Housing Specific Stimulus: The HomeBuilder Scheme and stamp duty waivers have now been unwound. There were 99,300 HomeBuilder applications received by the government, and a further 22,100 applications were received for ‘substantial renovation’. This would have brought forward a significant number of building approvals, underscoring a more benign outlook for building approvals in coming quarters.

b. APRA Increases Serviceability Assessment: The increased serviceability buffers introduced by APRA will not lead to a material reduction in housing loan growth because most borrowers are currently borrowing below their capacity. CBA recently reported that less than 10% of its borrowers were at maximum capacity. Further, the higher interest rate buffer will not materially impact fixed rate home loans – which account for 40% of new loans. This is because the interest rate floor (around 5%) used for fixed rates loans and the rate using APRA’s new interest rate buffer are materially similar. Nevertheless, macroprudential cooling measures impact housing sentiment. This combined with concerns of unsustainable growth and stubbornly high inflation, has resulted in a decline in the proportion of people who believe it is the right time to buy a home, accordingly to recent Morgan Stanley surveys.

c. Further Macroprudential Intervention: High debt to income lending has increased from 16% of loan approvals to 22%. Furthermore, housing credit growth is annualising at 8% relative to just 3% income growth. The Council of Financial Regulators is particularly concerned about this trend, as highly leveraged households act as a drag on consumption in periods of economic contraction. This is the area where further macroprudential intervention appears likely. Experience dictates that APRA will take an incremental approach, which will involve using one or more of the following macroprudential tools: (i) limits on high debt to income (DTI), which limit the maximum amount households can borrow relative to their incomes; and (ii) loan to value restrictions (LVR restrictions), which limit the amount that can be borrowed relative to the value of the property, and constrain the supply of credit to borrowers with low equity and liquidity buffers.

d. Pent Up Supply During Lockdown: Listings were 30% below the 5-year average over the last three months, so additional supply will place downwards pressure on housing prices as restrictions are lifted. The pent-up supply is likely to be particularly acute in Melbourne and Canberra where one-on-one inspections have not been allowed during lockdown.

e. Border Reopening: The removal of international border restrictions may act as a headwind by increasing emigration levels. Vastly different vaccination rates across the country mean a return to normalcy in Australia is a way off yet. There are no travel restrictions in Europe, where 48% of Australian emigration has historically been concentrated. Australians in capital cities have experienced extended periods of lockdown to stew over migration aspirations. Melbourne has been the most lockdown city in the world. In our view emigration will be more significant than most analysts expect as tens of thousands will wish to take action and regain their freedom and lifestyle.

f. Worsening Affordability Concerns: Annual growth in housing debt is on track to reach 10% later this year. The average owner occupier home loan in NSW has risen $112,000, or about 18% since February (ABS). For comparison, in the 2020-21 financial year wages grew by just 1.7% and household income growth was 1.8%. This means that housing values are rising 11 times faster than income. Unsurprisingly, it has never been more difficult to save a 10% home loan deposit.

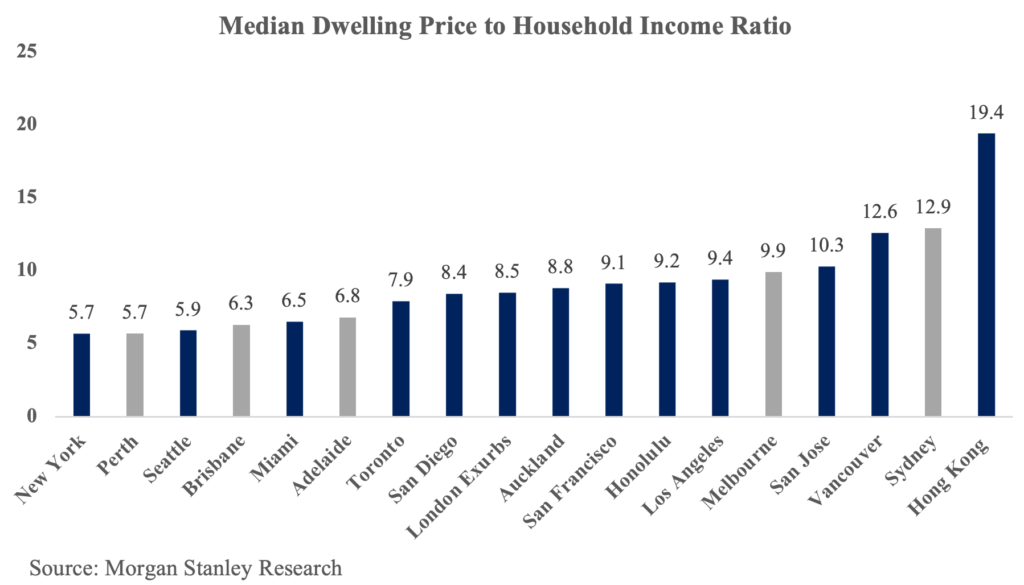

Australian median dwelling prices are already some of the world’s most expensive in terms of price-to-income. We believe, affordability concerns are likely to be a significant handbrake on further dwelling price growth.

g. Evergrande’s Liquidity Crunch: Concerns around Evergrande driving a financial contagion or broader slowdown in real estate seem to be overblown, considering the developer’s size relative to the bond market and residential construction sector. Preventing full blown financial contagion will be a priority for Beijing, as Evergrande owes a considerable proportion of its liabilities to small businesses, home buyers and even employees (Bondsupermart). This means household wealth will face severe implications in the event of a disorderly resolution. The stakes are high given real estate activity makes up 25% of Chinese GDP and real estate comprises 40% of household wealth. Chinese authorities have dealt with multiple high-profile defaults in the recent past – such as Baoshang Bank and HNA. They are likely to adopt a similar approach with Evergrande combining a mixture of government intervention, debt restructuring and calling on other entities to step in and conduct a “national service” (Bondsupermart). Beijing’s activities to date have backed this up.

Conclusion

There are signs that the breakneck speed of rising house prices has started to slow and Trident Real Estate expects this to continue. The slowdown should be supported by affordability concerns, the strong pipeline of houses for sale post lockdown, further macroprudential intervention by APRA and eventual interest rate increases. In the near-term while rates remain at record lows, we expect moderate price growth as buyers continue to chase gains in the property market. However, Trident Real Estate Capital does not believe the RBA will deliver on its commitment to keep rates on hold until 2024. Most recently the RBA’s decision to abandon its yield curve control in response to the bond markets has reinforced our belief. We expect rates to rise in 2023, triggered by persistently high inflation. Rate rises will be a game changer as real estate will need to be repriced. Unfortunately, history has shown that many investors will still be dancing well after the music has stopped!