The Great Decoupling: The Impact of US Trade Policy and Australian Strategic Response on the National Property Market

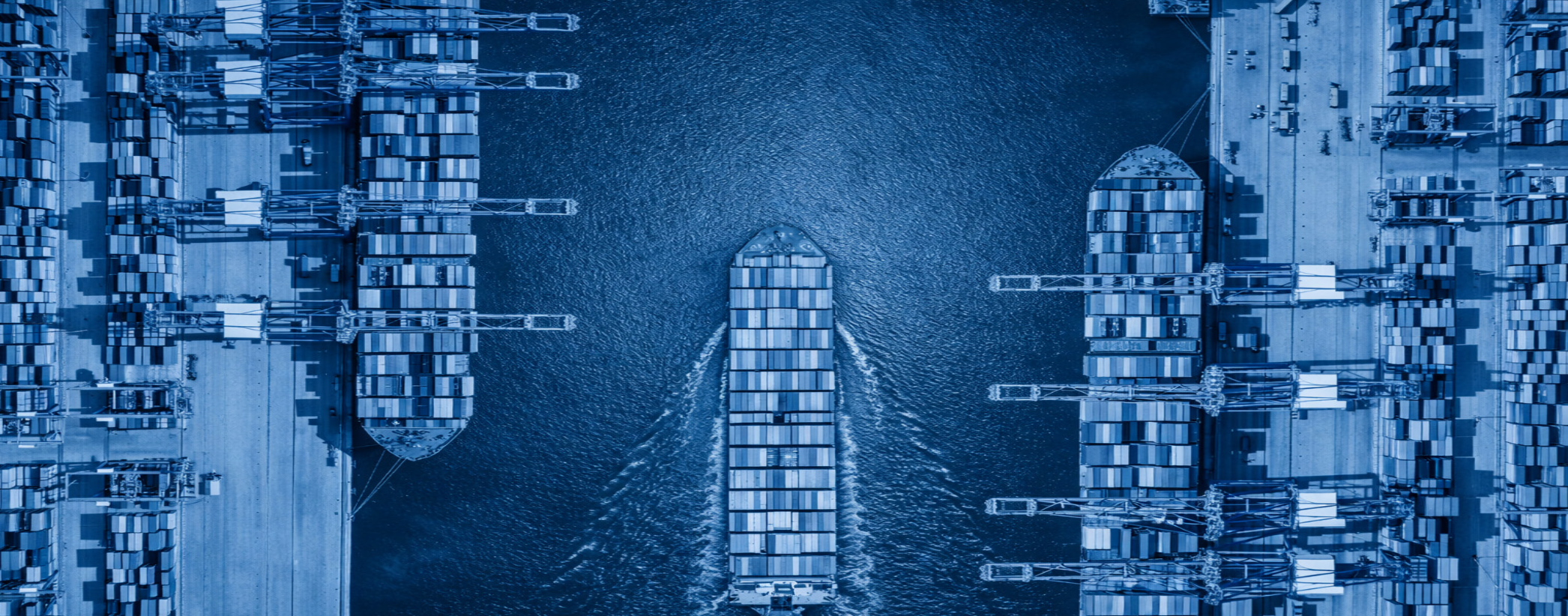

Ronald Reagan, the fortieth president of the United States of America, once said, ‘There’s a growing realisation that the way to prosperity for all nations is rejecting protectionist legislation and promoting fair and free competition.’ However, in the present day’s economic and geostrategic landscape, this notion has been irrevocably altered by a paradigm shift in global trade relations, precipitated by the inauguration of the second Trump administration and the subsequent implementation of the ‘Liberation Day tariff regime. For Australia, a mid-sized open economy deeply integrated into global supply chains, the direct effects of the tariffs have been disruptive yet within manageable bounds. It is primarily the underlying and indirect ripples of the trade disruption that impose complex and structurally transformative headwinds for the Australian property market. This comprehensive report analyses the multifaceted impact of the United States’ universal baseline tariff, the Australian Federal Government’s non-retaliatory “Five-Point Plan,” and the consequent ripple effects on the Australian real estate sector.

The Industrial Property Revolution

Since COVID-19 struck fear in the global economy, there has been an accelerated structural transition towards e-commerce causing investor appetite for industrial property to surge and for the asset class to outperform all other mainstream real estate sectors.

The funds chasing industrial properties have driven capitalisation rates for A-REIT industrial assets to firm to an average of 5.4% and it is forecast that this yield will further compress to below 5% by the end of 2021. Debt capital markets are singing to the same tune. Banks are actively reweighting their lending books towards the industrial sector and are prepared to increase loan to value ratios for industrial developments based on the perceived attractive risk profile of the asset class.

The question remains, has the surge gone too far, or is this simply the tip of the iceberg? In this paper, we explore the reasons behind the increasing investor demand for industrial property, and the changing nature of the asset class as it evolves to the new economic environment.

Is Australia Ready to Rent and Roll? Build to Rent: The Emergence of a New Real Estate Asset Class

The Build to Rent market in Australia has immense potential to scale with a very conservative market value of $40 billion equating to less than 1% of all Australia’s residential housing stock. Unsurprisingly, media and property industry groups are buzzing with the hype surrounding build to rent and the asset class’s perception as a solution to the growing affordable housing shortage.

Unfortunately, unfavourable taxation treatment and unnecessarily restrictive planning regulations have created a hostile environment for BTR to blossom. Perhaps the greatest hurdle that BTR projects must overcome is financial viability. Performance indicators such as project internal rate of return will always place BTR a distant second to a for sale development.

In this paper, we explore the likelihood of BTR to become an established asset class in light of the current political, legal, and economic conditions steering the direction of the Australian market.

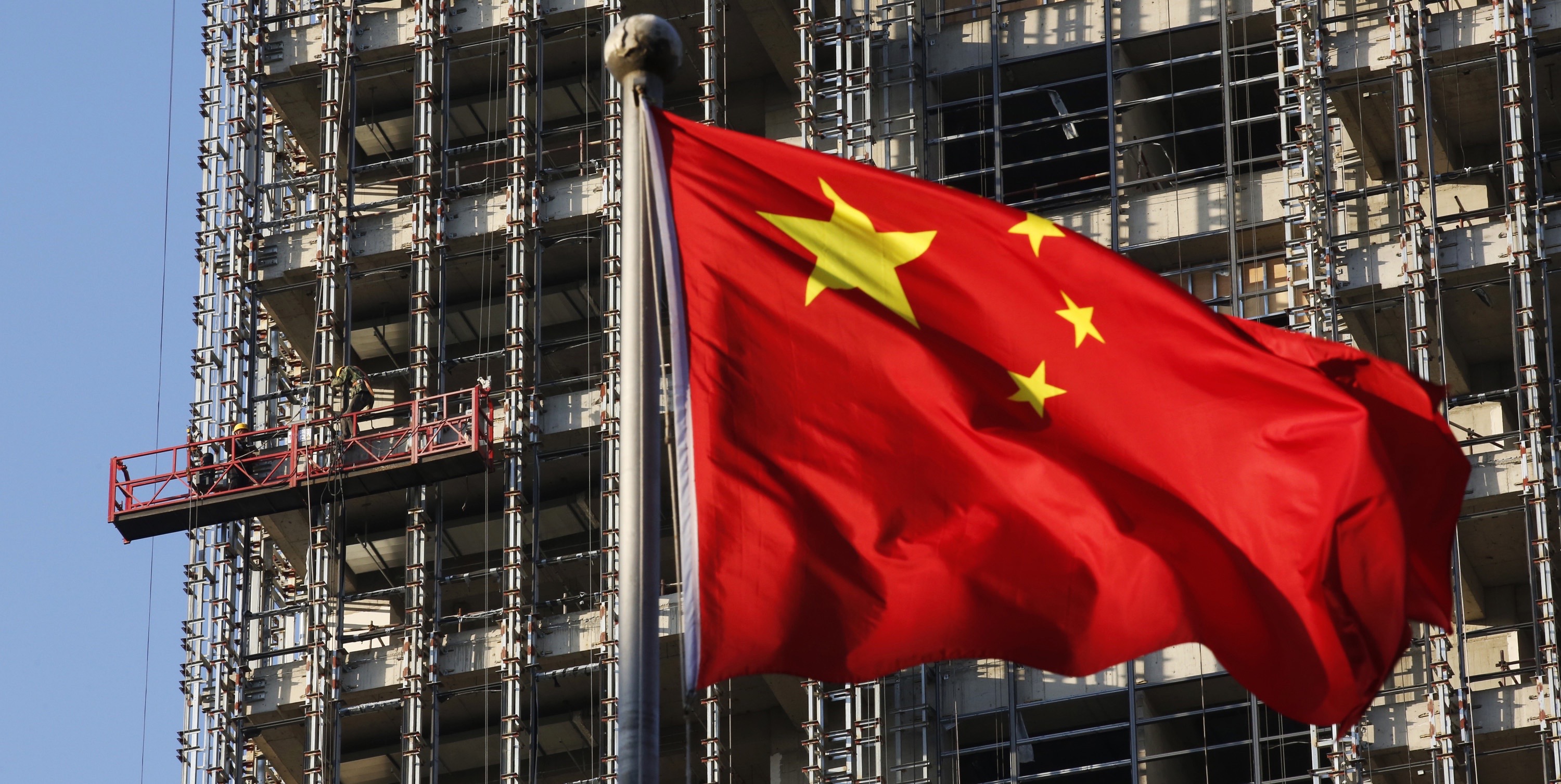

Leashing the Red Dragon: Chinese Investment in Australian Real Estate

China is Australia’s biggest foreign real estate investor, receiving approximately A$24.5bn worth of approvals for investment in Australian residential and commercial property in 2015 alone.

For Chinese nationals there are two overarching factors that are encouraging outflows of capital. Firstly, the general sentiment in China that the Renminbi will continue to depreciate, which is creating an impetus to expatriate funds. Secondly, a deep-seated concern that the Chinese system is not transparent or fair and that political instability may at any time threaten the accumulated wealth of Chinese companies and individuals. Investing in Australian real estate is therefore considered a value-protecting strategy.

Britain Unfriends the EU and Blocks Brussels: The Brexit and its Implications

By a majority of 52-48 the British people voted to unfriend the European Union and block the centralised command network in Brussels. Markets reacted to the Brexit in a wild selloff. The UK will inevitably face a difficult time dealing with political and economic uncertainties. Investors will begin to seek out safe haven assets, as the Brexit may be interpreted as the beginning of the end for the EU.

The Australian property market is likely to benefit from the chaos in Europe, being perceived by investors as a safe haven with robust returns derived from rental income. In this report, Trident Real Estate Capital examines the profound impact of the Brexit on global markets with a particular emphasis on real estate. Perhaps the Brexit presents an opportunity for Australia to shine as a destination for new foreign investment.

The Rise of Mezzanine Debt

Mezzanine debt is set to become an important source of capital for real estate investors, developers and those looking to refinance following the tougher capital regulatory requirements introduced by the Australian Prudential Regulation Authority and tighter underwriting by the big four banks.

Mezzanine finance bridges the gap between senior debt and equity investment. In our report, Trident Real Estate Capital examines the typical deal terms of mezzanine finance in a real estate transaction and utilises a case study to explain how mezzanine finance may boost expected returns for equity investors. The paper warns real estate players that before committing to mezzanine debt they must understand the real risk of increasing leverage in order to weigh up whether the expected return is commensurate with the additional risk and transaction complications.

Real Risk and Market Risk: A Mismatch of Perceptions?

The world faces a number of geopolitical crises: ISIS threatens the stability of Iraq, Syria and the rest of the Middle East; war is fracturing Ukraine; the Ebola virus continues to gain momentum in West Africa; and China is becoming more bold as it clashes with its neighbours over ownership of the South China Sea.

In our report, Trident Real Estate Capital examines the impact of these geopolitical crises on the Australian economy. We conclude that the markets are at significant risk of being complacent, as participants have not adequately responded to price in the current levels of inherent risk. The report submits that this behaviour is partly explained by the lax monetary environment as well as the unprecedented demand from foreign investors dampening any potential external shocks.

Fast & Furious: Residential Development in South Sydney

Inner South Sydney encompasses some of Sydney’s most culturally and economically diverse communities. Alexandria, Waterloo, Rosebery, Beaconsfield and Zetland, collectively South Sydney, are buzzing art-deco districts in the mists of a wave of new developments. In this research paper, Trident Real Estate Capital analyses the recent and rapid appearance of high rise apartment buildings in these suburbs. The paper considers the causes, potential hazards, and the future outlook of the growth in residential development in South Sydney.

Australian Real Estate Strategic Outlook

In this Australian Real Estate Strategic Outlook report, Trident Real Estate Capital identifies unit dwellings within 5km of the CBD as having the greatest potential for outperformance in 2013, particularly those first home buyer apartments in the $450,000 to $800,000 price bracket. On the flip side, the research report urges investors to exercise caution when considering Melbourne’s commercial property market. Trident Real Estate Capital believes that Melbourne will suffer in the near-term as a result of a multiplicity of factors including the contracting manufacturing sector, the decline in public sector investment and slowing private consumption.