Weather the Storm: Navigating Challenges in Australia’s Construction Industry

Navigating Challenges in Australia’s Construction Industry

The construction industry in Australia is currently navigating through a tempest of challenges, where powerful winds of skilled labour shortages, supply chain disruptions, and cost escalations threaten to shake its foundations. This tempest has left a trail of high-profile collapses in its wake, including industry players like Porter Davis, Probuild and civil construction firm Lloyds Group. These corporate collapses have been fuelled by the unrelenting pressure of soaring costs, the reluctance of major banks to provide construction loans and a dwindling property market. In this piece, Trident Real Estate Capital explores the myriad of challenges faced by the construction industry, providing analysis and commentary to shed light on this turbulent industry.

The Current State of the Market

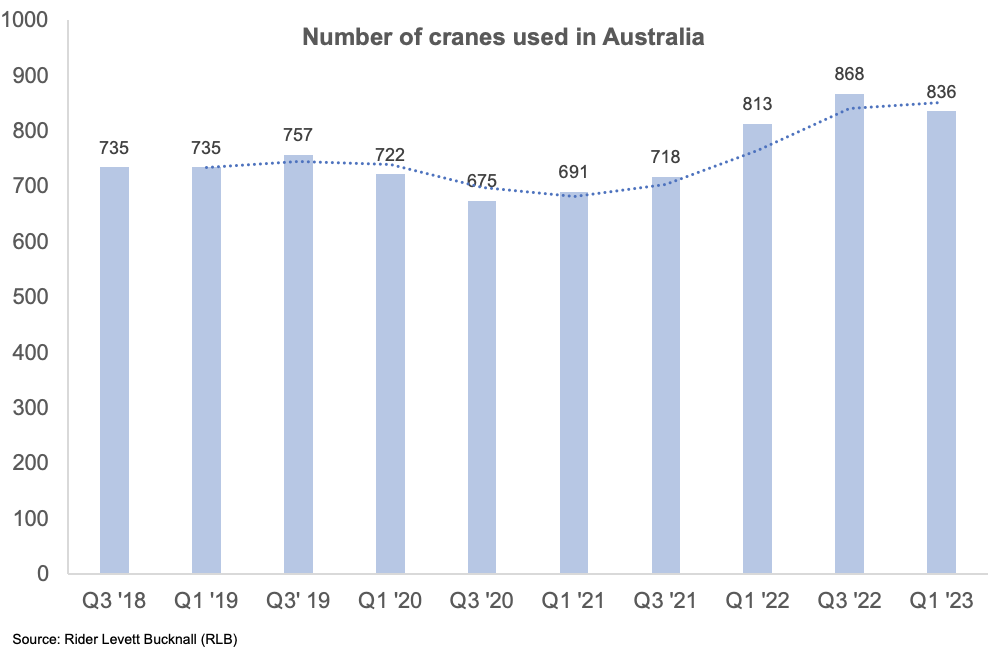

The construction industry in Australia witnessed a period of significant growth throughout 2021 and 2022. Notably, the RLB Crane Index reported the highest level of cranes operating in the country in a decade during the third quarter of 2022, with a total of 868 cranes indicating robust building activity. This surge in construction was supported by favourable conditions such as easy access to finance and an extended period of low cash rates, which remained at 0.10% from November 2020 until May 2022. These factors contributed to a thriving construction sector during this period.

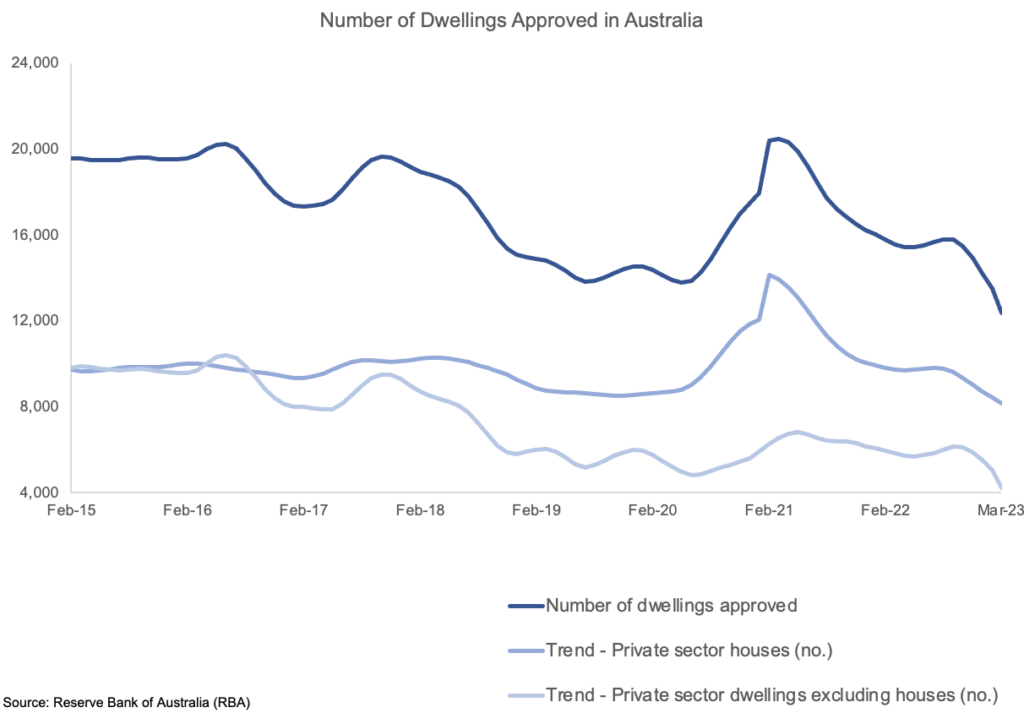

However, the recent series of interest rate hikes by the Reserve Bank of Australia (RBA), totalling twelve increases over the past year and bringing the cash rate to 4.1%, has had a noticeable impact on the construction industry. As a result, construction activity is currently experiencing a decline. According to official data from the Australian Bureau of Statistics (ABS), building approvals have seen a significant drop of 17.3% over the past 12 months. Specifically, approvals for the residential sector have decreased by 15.0%, while non-residential approvals have decreased by 20.9% (ABS). These figures indicate the challenging landscape that the industry is currently navigating.

Labour Shortages

The construction industry is grappling with severe labour shortages, which can be attributed to various factors. One significant factor is the aging population within the construction workforce, with many workers approaching retirement. In 1985, a mere 3% of the workforce was aged 59 and above, but that number has now climbed to nearly 10%. Consequently, the industry is increasingly dependent on young workers to fulfill the demand for skilled labour. Unfortunately, the rate of completions in training programs falls short of adequately replacing the aging workforce. Despite an increase in the number of registered apprentices in recent years, over 65% of these apprentices have withdrawn from the industry within the last five years. Shockingly, workers aged 24 and under account for a mere 4% of the entire construction workforce, highlighting the significant shortage of young talent in the sector.

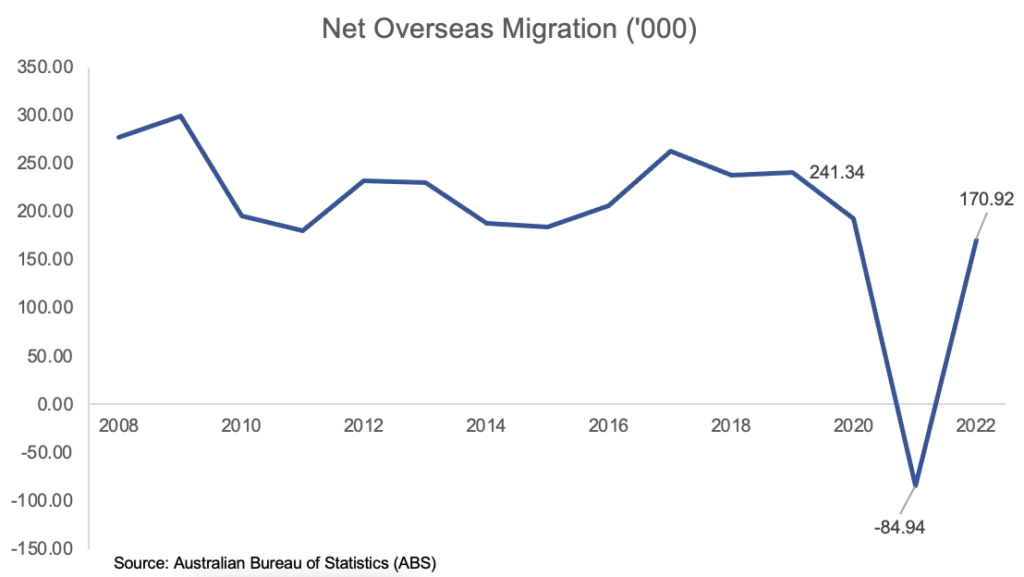

The lack of migration during the COVID-19 pandemic, arsing from border closures and lockdowns, has exacerbated labour shortages and has decreased the workforce below pre-pandemic levels.

As Australia’s borders gradually reopen in the aftermath of the pandemic, a surge in net overseas migration is anticipated, with projections indicating a staggering 400,000 migrants for 2023. This figure surpasses the original forecast of 235,000 made in October 2022 (Department of Treasury) by a remarkable 70%. While this influx holds promise for alleviating the strain caused by labour shortages, there remains uncertainty regarding the extent to which the construction workforce will benefit. It is expected that around 50% of the incoming migrants (Department of Home Affairs) will comprise international students, raising questions about their immediate availability and suitability for the industry’s workforce needs. Consequently, the construction industry will persist in grappling with the ongoing challenge of maintaining and expanding its future workforce capacity in the years to come.

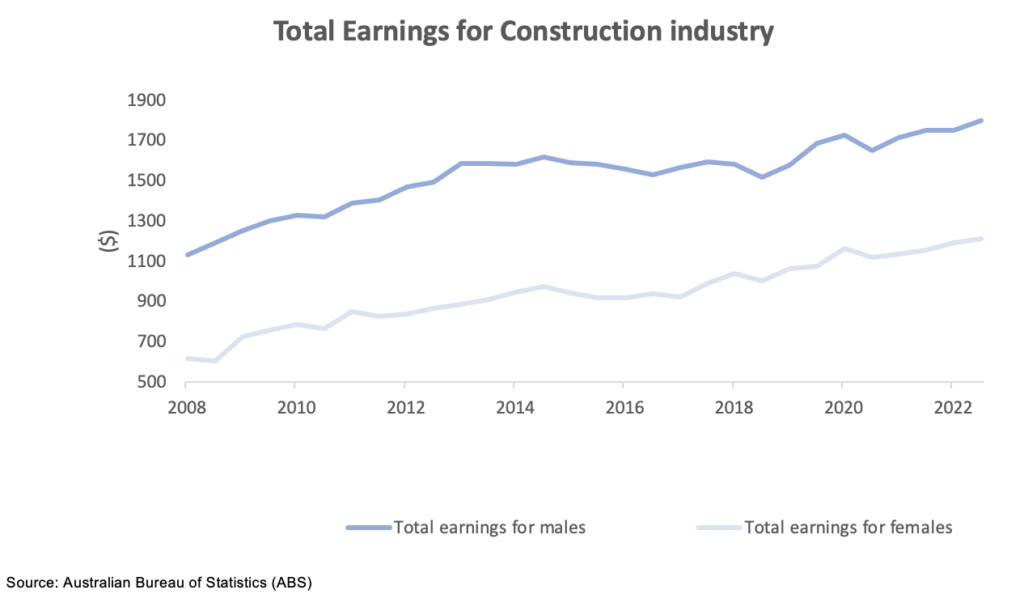

Due to persistent labour shortages, labour costs in Australia have been on a steady rise. The demand for skilled workers, such as electricians, plumbers, and carpenters, has been growing steadily, and the limited supply of these highly skilled professionals has granted them the ability to command higher wages. Consequently, the construction industry witnessed an average wage increase of 5.8% for construction labourers in 2022 (ABS). With inflation on the rise, it is expected that wages will continue to climb further. In fact, annual wage increases agreed upon in enterprise bargaining agreements have often surpassed the inflation rate. As a result, builders must brace themselves for higher labour expenses in the upcoming periods. Regrettably, the impact of the skilled labour shortage extends beyond increased costs, manifesting in project delays and a decline in workmanship quality.

Supply Chain

There is no doubt that the global supply chain was severely impacted by the pandemic. This disruption was due to multiple factors but particularly pent-up demand. For example, there were significant spikes in the cost of steel mainly due to the demand surges from China. Steel prices jumped 69.2% from May 2020 to May 2021 and a further 24.7% from November 2021 to May 2022 (Trading Economics). These cost increases raised the overall costs of existing construction projects as steel is very commonly used for structural framework, concrete reinforcement, and roofing. Similarly, the lumber prices also spiked 392.1% from May 2020 to May 2021 and a further 197% increase from August 2021 to February 2022 (Trading Economics). Timber is integral in construction projects for structural framework, wall systems, flooring and cabinetry. As a consequence of these increases, deployed materials costs have been accounting for a significant portion, ranging from 15 to 25%, of the total construction costs (RBA).

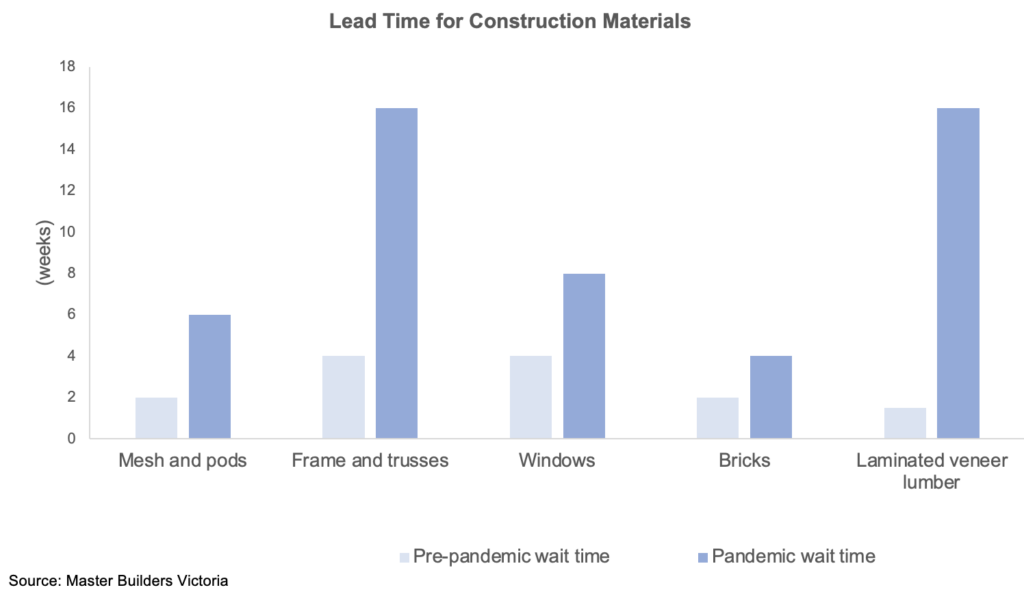

Further to cost increases, the supply chain disruptions also have caused extended delays in sourcing materials. For example, lumber had lead times of 16 weeks during the pandemic. These delays are particularly problematic for projects with tight deadlines. Long lead times for integral construction materials result in delays to the critical path of the project and delays in practical completion dates, leading to many builders having to pay penalties for late delivery.

Rising Cost

The construction industry has recently confronted a range of external disruptive forces, including rising regulatory compliance costs, increasing financial instability, and mounting insolvency issues.

In recent years, the Australian government has implemented a series of regulations aimed at enhancing accountability, elevating safety standards, and reducing the environmental impact of construction projects. While these regulations are laudable in their objectives, they have translated into increased construction costs. Consequently, the industry now faces the pressing question of who should bear the weight of these additional compliance expenses.

For instance, the NSW government recently enacted the Design and Building Practitioners Act 2020 (NSW) (the Act) which imposes new obligations for builders, designers, and engineers involved in Class 2 buildings. The Act establishes a statutory duty for those engaged in construction work to exercise reasonable care in order to prevent economic losses caused by faulty workmanship. Consequently, builders now face heightened litigation risks, leading to significant increases in professional indemnity insurance costs, higher excesses, and reduced coverage within this insurance category.

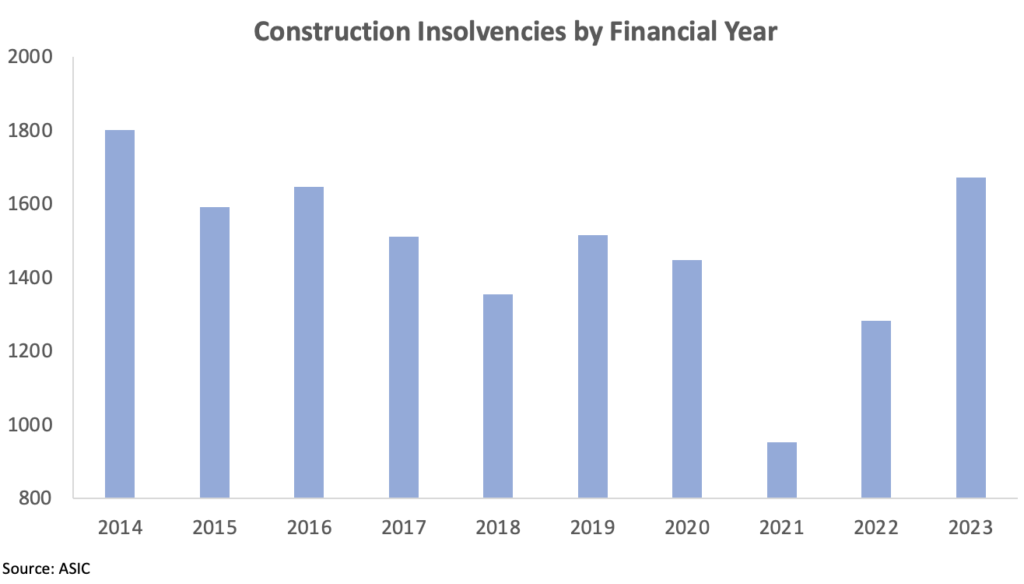

Builders commonly engage in lump sum contracts for construction projects, wherein they commit to completing the project at a pre-determined cost. Under such contracts, builders bear the responsibility of pricing the project which is an inherent risk, particularly in scenarios where long lead times and unpredictable cost fluctuations are prevalent. Unfortunately, these lump sum contracts have left many builders vulnerable to significant increases in material prices, which have risen by an average of 20% since 2021 (RBA), as well as surging labour costs. Consequently, numerous builders are now faced with unprofitable or even loss-making projects, resulting in negative cash flows. The construction industry has witnessed a surge in insolvencies, with ASIC reporting the highest failure rates in nearly a decade, reaching a staggering 1,672 insolvencies among companies in external administration. The recent liquidation of Porter Davis in March affected approximately 1,700 homes under construction, highlighting the impact of these insolvencies on both builders and homeowners. Other prominent builders, including Lloyd Group, Oracle, Pivotal, and Condev, are also facing financial challenges and are under external administration. We anticipate that further insolvencies will arise in the near future as builders continue to grapple with lump sum contracts entered into when material and labour costs were significantly lower, compounded by the higher finance costs resulting from increased interest rates.

Conclusion

The Australian construction industry is currently facing a multitude of challenges, including labour shortages, disrupted supply chains, and rising costs. These difficulties have resulted in the collapse of prominent builders, underscoring the industry’s vulnerability. Nevertheless, there are glimmers of hope amid the adversity. The surge in migration numbers following the pandemic provides a potential solution to alleviate labour shortages, although long-term workforce capacity remains a concern. Furthermore, as inflationary pressures and rising interest rates dampen demand, the strain on supply chains is expected to ease, allowing for a gradual return to normalcy and a possible reduction in material prices. Despite the industry’s resilience and positive activity levels, ongoing tests and volatility are to be expected.

In this challenging environment, businesses operating on thin margins and with inadequate cash flow management are unlikely to withstand the pressures. The construction industry holds a significant position as Australia’s third largest sector, but the impact of company failures extends far beyond financial repercussions. These failures can have severe social consequences and even disrupt our entire economy. To ensure continued success, it is essential to improve cash flow management and cost risk sharing practices. Emphasizing advance payment arrangements can enhance cash flow management, while adopting fairer contract models with price adjustment clauses will distribute cost escalations more equitably among builders and developers. By prioritizing these strategies, the industry can bolster its financial stability and ensure smoother operations in the face of persistent obstacles.