Inflation : A Permanent-Transitory Conundrum

Bifurcation is defined in the Oxford Dictionary as dividing into two branches or forks. Never has a word been as apt to describe the current environment of skyrocketing property prices and record stock market highs on the one hand and on the other hand inflationary fears. In this piece we will explore the extent to which markets are concerned with the risk of inflation rearing its ugly head and analyse whether the current spike in inflation is merely transitory, or here to stay. We will conclude by considering if real estate is a good hedge in an inflationary environment.

Inflation Environment

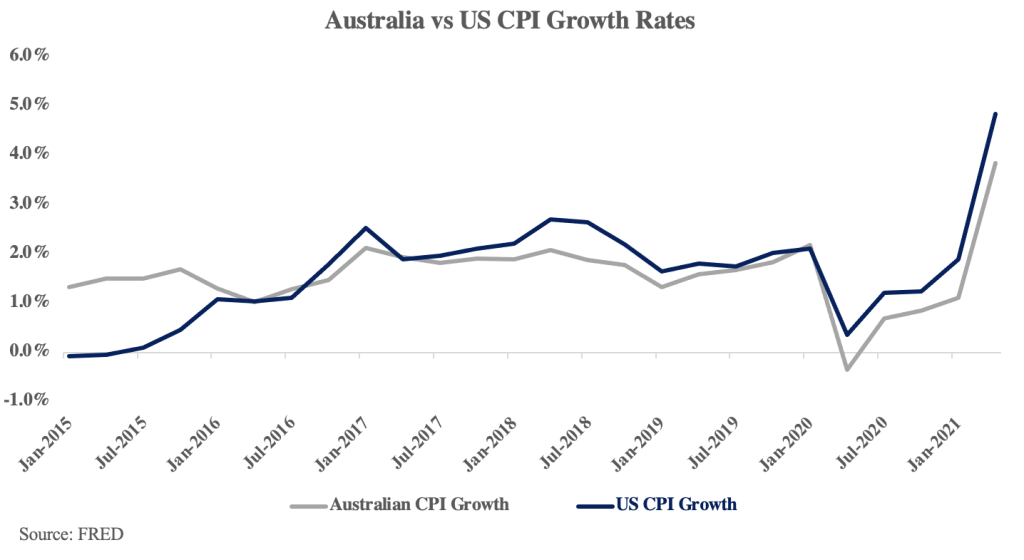

Australia’s inflation rate spiked to 3.8% in the year to the June quarter. This follows inflation rates of 5.4% in the US, 3.3% in NZ and 3.1% in Canada. These figures reflect a combination of travel restriction induced labour shortages, supply chain disruptions and strong consumer demand facilitated by COVID-19 relief payments. The latter two factors look as though they will continue to linger for some time yet. Meanwhile, central banks around the world are committed to expansionary monetary policy for the foreseeable future. This has sparked concern that we may be heading for a significant period of higher inflation.

What does the Reserve Bank Think?

The Reserve Bank has expressed the view that the current spike in inflation reflects a correction rather than a trend. This view is supported by some empirical evidence namely (1) fuel prices rose by 6.5% due to the continued recovery following the COVID-19 lockdowns of 2020, (2) the removal of the Federal Government’s free childcare package resulting in increased childcare costs and (3) furniture rose 3.8% with strong demand for timber and supply constraints contributing to price rises in timber-based furniture.

The Reserve Bank has turned to the underlying inflation rate, which is sitting at 1.6%, to remove these large one-off price impacts. Comparing current CPI figures to pre-pandemic levels shows that over the last 5 quarters inflation rose by just 1.9% (RBA). However, the RBA board members are not highly confident about their expectations. One major source of uncertainty is the behaviour of prices and wages at low levels of forecast unemployment. It has been four decades since Australia sustained an unemployment rate of 4% (which leaders now believe is the full employment level), complicating forecasting significantly. Notwithstanding, what we can note with some certainty is the following, (1) tighter labour markets (especially those constrained on the supply side because of closure of international borders) do generate stronger wage increases, and (2) this relationship seems to be compounded at unemployment rates below 5%.

What do the markets tell us about Inflation?

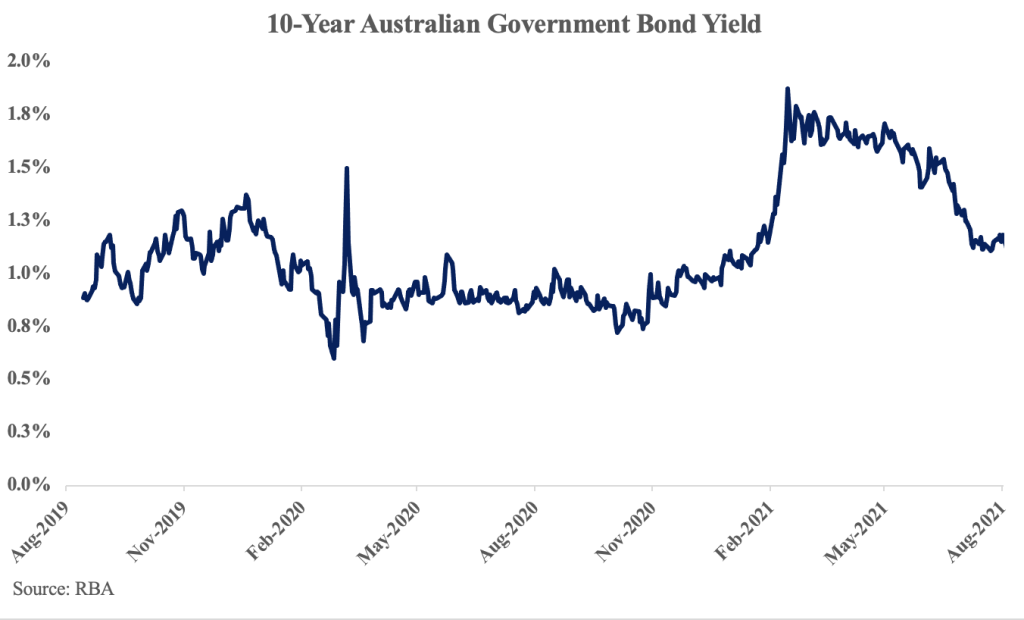

Bond market signals appear to point towards the rise in inflation being transitory and that growth may be stalling. In Australia sovereign bond yields have declined significantly at the long end of the curve since March 2021. The Australian 10-year bond yield has had a downward trajectory for the last 5 months and is currently 1.268%. Australia’s 10-year breakeven rate, a market measure of inflation expectations, fell six basis points in July and now sits just below 2% (Morgan Stanley). It should be highlighted that the sharp falls in bond yields may be linked to the serious outbreak of the delta variant and a deterioration in the appetite for risk as well as acknowledgement of the risks of future variants emerging and disrupting global recovery.

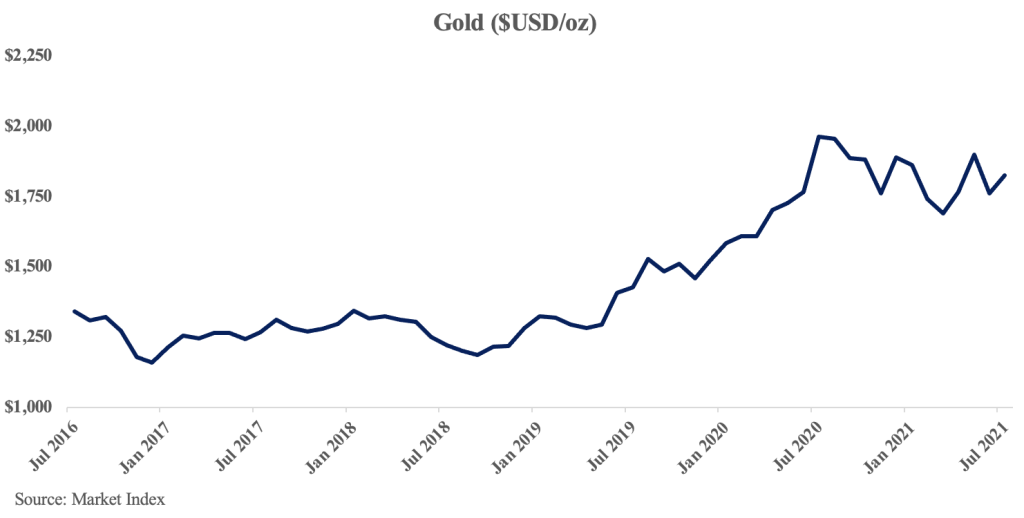

Gold has historically been bought as a hedge for inflation. Despite all the fears of inflation, the market for gold seems to agree with the bond market that the inflationary spike is transitory. The price of gold reached an all-time high of $2,067 in August 2020, likely driven by the Federal Reserve’s enormous quantitative easing program. And then, in August 2021, when concerns about inflation were rising, it fell to $1763, down 15% from the high reached 12 months earlier.

The trajectory of the ASX also seems to point towards a benign outlook for inflation. In July 2021, when inflation concerns were rising, the ASX200 closed at a then record high of 7,431 points. The index continued to rise aggressively in August before having some gains wiped off by earnings announcements in the second week of reporting season, as of the date of writing the ASX sits at 7,406 points. This is reflective of trillions of dollars of liquidity being injected into markets. There appears to be little thought of rising interest rates given the economic weakness arising from current lockdowns in Australia, rising unemployment and the fall in spending.

Outlook for Inflation

Given the mixed messages from the markets, below we consider the key factors bearing upon Australia’s inflation outlook. There are a handful of factors weighing on inflation from both sides of the isle.

The following factors support the view that inflation is transitory:

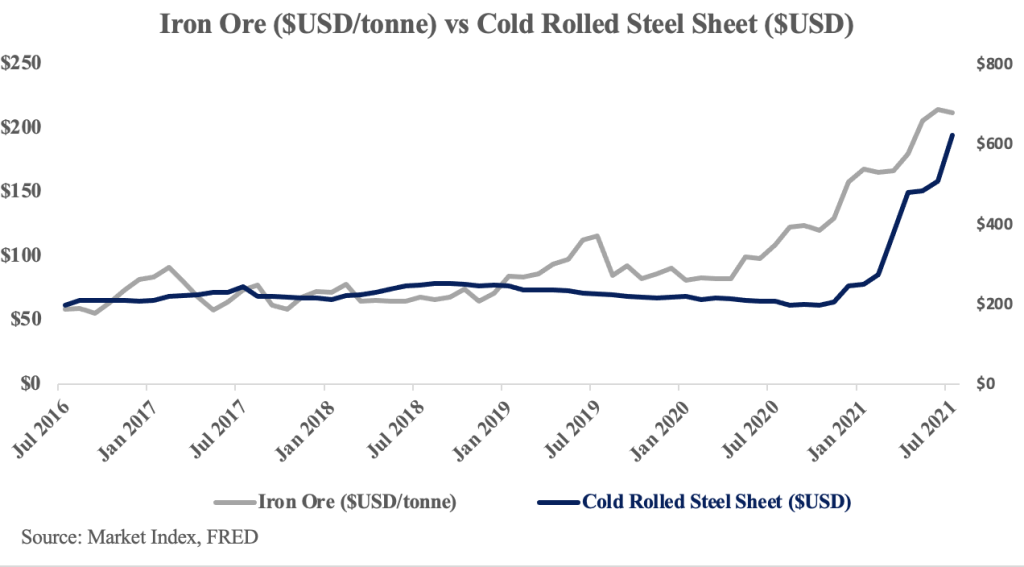

a. Raw materials and costs – Input shortages will continue to create inflationary headwinds. Material markets are experiencing higher demand due to COVID-19 economic stimulus and there has been widespread supply chain interruptions. Steel prices have almost doubled over the past year from $1,100 per tonne to nearly $2,000 per tonne for structural steel products on the back of steel exports from China plunging by more than 50 per cent in recent months. Copper prices have also skyrocketed due to increased demand and reduced supply from Chile in the pandemic (CME Group). Builders are now having to wait 16 weeks to receive laminated veneer lumber. This is up from a one and a half week wait before the pandemic. These construction shortages leave builders exposed to rising costs. Hutchinson Builders estimates that rising steel prices during the past 12 months have shaved at least 10 per cent off the company’s already slim profit margins;

b. Causal Workers – Welfare payments and grants have resulted in many casual workers earning more income than they would ordinarily if they were working. This reflects the fact that Jobsaver Payments and COVID-19 Disaster Payments have not been closely indexed to the number of hours that workers were putting in before lockdown. Accordingly, many of the 24.4% of Australian employees who are casual workers have received significantly more income during lockdowns (ABS). Separately government data shows that a staggering 864,000 persons are receiving COVID Disaster payments, this is equivalent to one fifth of all workers in Australia’s workforce. Inevitably, these unemployment benefits will be progressively rolled back towards the end of this year as vaccination rates increase and businesses are able to recommence trading. This should bring more workers into the job market, reducing the impact of labour shortages on wages and the price of goods;

c. Policy Instruments – The recent levels of stimulus, deficit spending and quantitative easing will recede as the country emerges from lockdown. The Reserve Bank has already advised the market of its intentions to reduce its rate of government bond purchases to a rate of $4 billion per week from September until at least mid-November 2021;

d. Government stimulus and COVID-19 grants in NSW will also decrease significantly as vaccination rates increase. Accordingly, these factors will decline relative to the size of the economy, which will act as a drag on inflation going forward; and

e. Inflationary expectations are a very important driver of actual inflation. Expectations have risen significantly globally in countries such as the US where there has been tangible evidence that we are approaching a period of higher inflation. In the US, prices for used cars, houses and materials have skyrocketed in 2021 (FRED). These rapidly rising prices could cause inflationary expectations to become embedded in American psyches, creating a self-perpetuating cycle. Expectations are still lagging behind in Australia where many investors are taking a transit view. This may be the by-product of persistently below target inflation in Australia over the past five years.

There are also several factors which point towards a more protracted period of high inflation:

a. Labour supply shortages will continue to provide inflationary headwinds. Border restrictions are contributing to acute labour shortages. Job ads/placements are up more than 50% on pre-COVID levels. Supply is also lower with a 33% drop in applicants relative to 2019. In real terms this reflects a decrease in the number of applicants per job from 30 to 21 on average. Construction has seen a 40-50% increase in jobs/placements. Wages in construction and mining are seeing annual increases of 10-15% on average (Jarden). The Financial Services industry has seen even higher wage increases of 20-30% for in demand roles. So far across these industries, wage increases have been largely for new hires. However, they are expected to flow on to the broader workforce within the course of the next 12-18 months;

b. Australia is headed for a protracted period of budget deficits increases as a percentage of GDP. The Federal Government is expecting net debt to be 34.2% of GDP this financial year, up from 24.7% in 2019-20. The Federal Government is injecting billions of dollars of additional liquidity into the Australian economy in the form of benefit payments. The COVID-19 Disaster Payments are being provided throughout Australian to individuals who have had their hours reduced in lockdown. Support is also being offered for businesses through means including Job Saver Grants and COVID-19 Business Grant Relief. There has also been a reduction in social security deeming rates, tax cuts for low to middle income earners and significant infrastructure commitments by the federal government including $2billion committed for the Great Western Highway upgrade in NSW and a further $2billion for the new Melbourne Intermodal Terminal;

c. Consumer balance sheets have improved on the back of higher incomes, delayed spending and the inability to enjoy a holiday. Household disposable income has continued to grow throughout the whole pandemic. Household savings ratios and consumption spending have recovered significantly in 2021. The savings rate has come down from almost 23% of income in 2020 to 12%, while consumption growth has increased from -12% to 0% currently (RBA). In the back half of 2021 while stimulus payments continue, these trends will continue to provide an inflationary headwind. However, consumer demand should ebb significantly at the end of the year and into next when fiscal stimulus is removed, and domestic borders begin to open; and

d. The rapid expansion of the monetary supply through quantitative easing and low interest rates will also provide inflationary pressure. The RBA is currently purchasing $5 billion of government bonds per week and the cash rate is very accommodating at 0.1%. By the end of November 2021 the RBA will have cumulatively purchased under the bond purchase program $237billion. This has flooded financial markets with additional liquidity, driving strong price increases in capital markets. Globally stock market gains have totalled double-digit trillions of dollars and house prices have soared. This is creating a significant wealth effect that is driving consumer demand.

How does rising Inflation impact Real Estate?

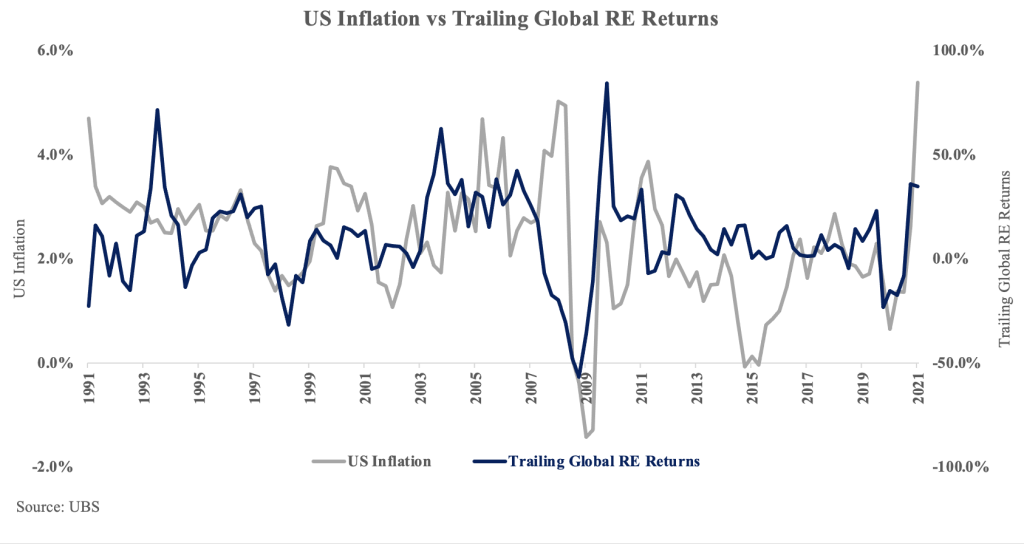

Historically, real estate appears to be an inflation hedge. Investors tend to favour real assets in inflationary environments. Data from UBS indicates that real estate typically outperforms equities in high inflation environments, but the benefit tails off when CPI rises above 4%.

However, inflation has a much more complicated relationship when it comes to property and depends on a number of variables.

Rent Structure

Real estate will perform with inflation if the rent structures that underpin the asset’s cash flows are indexed to inflation. In Australia, for example, retail leases generally have fixed rental increases in the range of 3-4% or annual rental increases linked to inflation plus 2.0-2.5%. Office and industrial rent reviews are typically a mixture of inflation linked increases and fixed increases. Where an asset’s rental increases are indexed to inflation we would expect that asset to perform well, however, where rent reviews are based on fixed increases, these increases may not keep up with the time value of money creating a situation where the value of the lease actually decreases year to year.

Finance

Finance is another variable impacting a landlord’s levered cashflow. Inflation will drive the cost of debt upwards by way of higher interest rates. This means servicing costs for debt will increase and levered cashflows will be adversely impacted. Those real estate assets that are financed with long-dated fix-rate debt will be in a much better position than assets financed with variable rates and short-term maturity. It should also be noted that in times of high inflation banks are less willing to lend and finance costs are much higher. Such behaviour by banks would result in significant contractionary effects for real estate and the supply of credit shrinks.

Interest Rates and Cap Rates

Capitalisation rates are used in real estate valuation analysis. The cap rate is defined as the stabilised net operating income divided by the property value. The cap rate consists of the risk-free rate plus a risk premium minus growth expectation of rental income. Inflation would therefore increase the cap rate by forcing the risk-free rate to rise, and higher cap rates reduce property valuations. That being said, inflation will also have some upward impact on rental income which may partially offset the increasing cap rate and contain the overall impact on valuation. However, as inflation grows above the 3-4% mark the cap rate increase will disproportionately impact real estate valuations and force real estate prices downwards.

Conclusion

It should be noted that the writer is of the school of agnosticism when it comes to considering what the macroeconomic future holds. To quote Howard Marks, “It may be hard to admit – to yourself or to others – that you don’t know what the macro future holds, but in areas entailing great uncertainty, agnosticism is probably wiser than self-delusion.” That being said, it is important to have an understanding of the macroeconomic issues that may impact investment decisions even if it is not possible to predict the macro environment, particularly when your business is investing in real estate.

Looking into the future, it is important to acknowledge that real estate does not always provide a good inflation hedge. The important qualification here being that real estate suffers when headline inflation is above 4%. The extent of this suffering ,among other things, depends on the structure of debt and the manner in which rent increases are calculated. Headline inflation may remain persistent in the medium term while the RBA focusses on underlying inflation and continues to buy billions of dollars of government bonds every week. Perhaps the future may not be as rosy for real estate as some may expect!