Trident Real Estate will undertake principal investing from time to time on the condition that there is no conflict of interest.

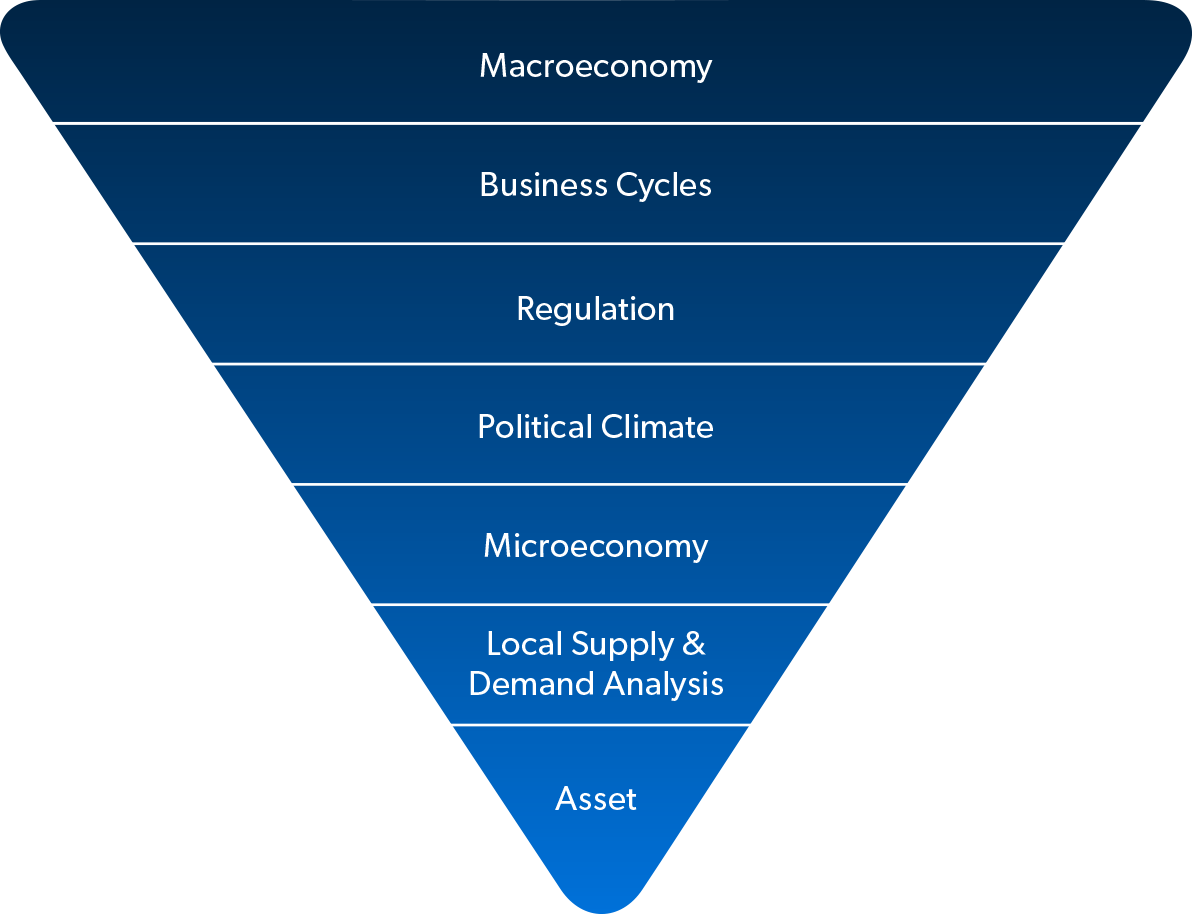

Trident Real Estate adopts a top-down investment approach beginning with an analysis of the business cycle as well as the macroeconomy before undertaking a detailed microeconomic review, a key element of which is a supply and demand assessment at the asset level. This analytic approach together with our experience and deep knowledge of commercial property has allowed Trident Real Estate to identify and acquire assets that deliver outstanding risk adjusted returns.

Trident Real Estate’s investment strategy focuses on making value-oriented investments in distressed and undervalued property assets. This strategy involves acquiring real estate which can deliver a high income return and growth in capital value. Significant value may be unlocked using our active asset management expertise including lease programmes, asset and tenancy repositioning, managing complex building refurbishments and developments to enhance value, as well as improving operating efficiencies.

Trident Real Estate focuses on South Sydney commercial real estate where the team manages a significant portfolio. Our intimate knowledge of the local market and experienced resources allows us to anticipate the requirements of our tenants and the buildings they occupy. We are committed to a strong tenant/landlord relationship and believe honesty and integrity is a critical ingredient in realising superior risk-adjusted returns.

For more information on our investment approach, please contact our office.